Jump to Section

Understanding the Importance of Financial Planning

Financial planning is an essential aspect of managing the economy of any country. The main goal of financial planning is to ensure that financial resources are allocated efficiently to achieve the desired economic objectives.

In India, financial planning plays a crucial role in shaping the country’s economic landscape. It provides a framework for policymakers to make informed decisions that promote economic growth, job creation, and poverty reduction.

Financial Planning: A Key Driver of India’s Economic Growth

Financial planning is a key driver of India’s economic growth.

It helps to ensure that the country’s financial resources are allocated efficiently.

This, in turn, promotes economic growth, job creation, and poverty reduction. The Indian government has recognized the importance of financial planning and has taken several steps to promote it.

For instance, the government has established various institutions that are responsible for financial planning, such as the Reserve Bank of India, the Securities and Exchange Board of India, and the Ministry of Finance.

The Benefits of Effective Financial Planning for Individuals and Businesses

Effective financial planning offers numerous benefits to both individuals and businesses.

For individuals, it helps to ensure that they can achieve their financial goals, such as saving for retirement, buying a home, or paying for their children’s education.

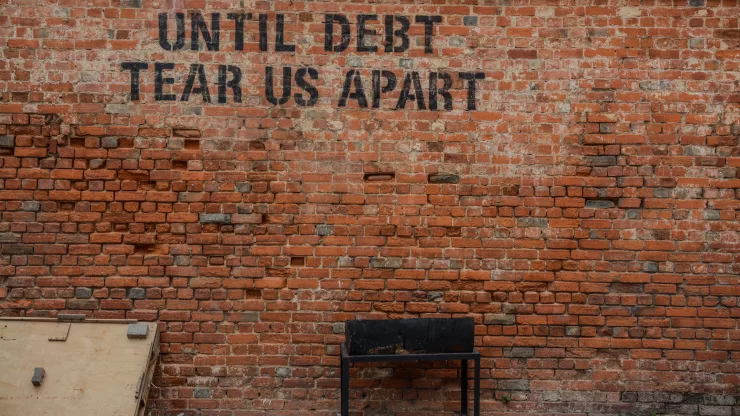

It also helps them to manage their debt and reduce their financial stress. For businesses, financial planning helps to ensure that they can manage their cash flow effectively, invest in new projects, and expand their operations.

It also helps them to manage their risks and make informed decisions.

The Role of Technology in Revolutionizing Financial Planning in India

Technology has revolutionized financial planning in India. With the increasing use of digital platforms, individuals and businesses can access financial planning tools and services easily.

For instance, there are various mobile apps that provide financial planning services, such as budgeting tools, investment calculators, and retirement planners.

Moreover, technology has made it easier to access financial markets, invest in stocks, and manage portfolios.

This has made financial planning more accessible and affordable for everyone.

The Future of Financial Planning in India: Challenges and Opportunities

The future of financial planning in India is bright, but it also faces several challenges. One of the main challenges is the lack of financial literacy among the population.

Many people do not have the knowledge or skills to manage their finances effectively, which can lead to debt and financial stress. Another challenge is the lack of access to financial services, particularly in rural areas.

However, there are also many opportunities for growth in the financial planning sector, such as the increasing demand for financial services, the growth of the middle class, and the increasing use of technology.

The Power of Financial Planning in Shaping India’s Economic Landscape

In conclusion, financial planning plays a crucial role in shaping India’s economic landscape. It helps to ensure that financial resources are allocated efficiently, which promotes economic growth, job creation, and poverty reduction.

Effective financial planning offers numerous benefits to both individuals and businesses, and technology has revolutionized the sector. While there are challenges to be addressed, there are also many opportunities for growth.

By promoting financial literacy, expanding access to financial services, and leveraging technology, India can continue to harness the power of financial planning to achieve its economic goals.

FAQ

What is financial planning?

Financial planning is the process of managing financial resources to achieve specific financial goals. It involves creating a budget, managing debt, investing in assets, and managing risks.

Why is financial planning important?

Financial planning is important because it helps individuals and businesses to manage their finances effectively. It ensures that financial resources are allocated efficiently, which promotes economic growth, job creation, and poverty reduction.

How can technology help with financial planning?

Technology can help with financial planning by providing access to digital platforms, mobile apps, and online tools. These tools can help individuals and businesses to manage their finances, access financial markets, and invest in stocks.

Technology has made financial planning more accessible and affordable for everyone.

With a deep passion for personal development, Ben has dedicated his career to inspiring and guiding others on their journey towards self-improvement.

His love for learning and sharing knowledge about personal growth strategies, mindfulness, and goal-setting principles has led him to create My Virtual Life Coach.

Contact Ben at [email protected] for assistance.